"Executive Summary Third Party Cyber Insurance Market :

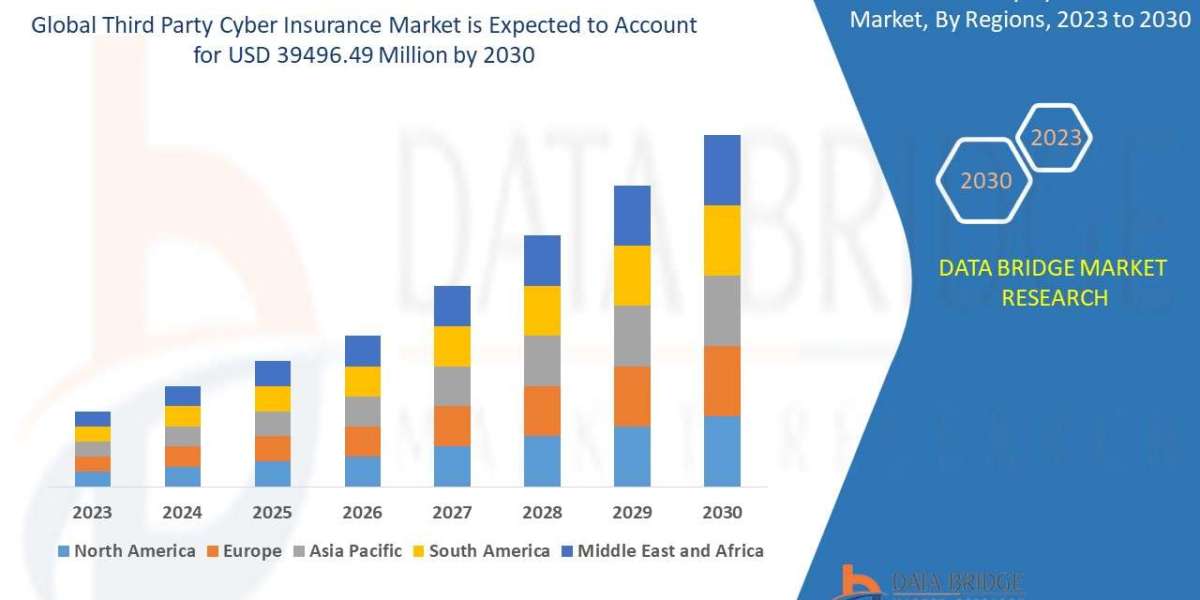

Data Bridge Market Research analyses that the third party cyber insurance market was valued at USD 7738.10 million in 2022 and is expected to reach the value of USD 39496.49 million by 2030, at a CAGR of 22.60% during the forecast period.

The market insights and market analysis about industry, made available in this Third Party Cyber Insurance Market research report are rooted upon SWOT analysis on which businesses can depend confidently. This market study underlines the moves of key market players like product launches, joint ventures, developments, mergers and acquisitions which is affecting the market and Industry as a whole and also affecting the sales, import, export, revenue and CAGR values. The consistent and extensive market information of this report will definitely help grow business and improve return on investment (ROI). This report makes available an actionable market insight to the clients with which they can create sustainable and profitable business strategies.

The Third Party Cyber Insurance Market report makes your business well acquainted with insightful knowledge of the global, regional and local market statistics. By keeping end users at the centre point, a team of researchers, forecasters, analysts and industry experts work exhaustively to formulate this market research report. To achieve maximum return on investment (ROI), it’s very crucial to figure out brand awareness, market landscape, possible future issues, industry trends and customer behaviour and Third Party Cyber Insurance Market report does the same. This Third Party Cyber Insurance Market report conveys the company profiles, product specifications, capacity, production value, and market shares of each company for the forecasted period.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Third Party Cyber Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-third-party-cyber-insurance-market

Third Party Cyber Insurance Market Overview

**Segments**

- Based on Coverage, the Global Third Party Cyber Insurance market can be segmented into:

- First-Party Coverage

- Third-Party Coverage

- On the basis of Application, the market is categorized into:

- Healthcare

- Retail

- Government

- Financial Services

- Technology

- Others

- Considering End-User, the market can be divided into:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

**Market Players**

- Some of the key market players in the Global Third Party Cyber Insurance Market include:

- AIG

- Chubb

- Zurich Insurance Group

- Allianz

- AXA

- Berkshire Hathaway

- Munich Re Group

- Travelers

- Beazley

- XL Group Ltd.

- Liberty Mutual

- Generali

In recent years, the Global Third Party Cyber Insurance market has witnessed significant growth due to the increasing number of cyber threats and data breaches around the world. Organizations, both large enterprises, and SMEs are recognizing the importance of having comprehensive cyber insurance coverage to mitigate financial losses and reputational damage resulting from cyber-attacks. The market segmentation based on coverage type, application, and end-user helps insurers tailor their products to meet the specific needs of different industries and business sizes.

First-party coverage, which includes direct losses to the insured organization, and third-party coverage, which covers liabilities towards third parties affected by a cyber incident, are the two primary coverage types driving market growth. Industries such as healthcare, retail, government, financial services, and technology are the prominent application segments demanding cyber insurance due to the sensitive nature of the data they handle. Large enterprises have been early adopters of cyber insurance, but SMEs are increasingly recognizing the value of such policies to safeguard their operations.

Market players like AIG, Chubb, and Zurich Insurance Group are at the forefront of offering innovative cyber insurance solutions to cater to the evolving needs of organizations in the face of constantly evolving cyber threats. These players focus on providing comprehensive coverage, risk assessment services, and incident response support to enhance the cyber resilience of their clients. With the rise in regulatory requirements related to data protection and privacy, the demand for third-party cyber insurance is expected to surge, further driving market growth.

The Global Third Party Cyber Insurance Market is poised for robust expansion as businesses across sectors prioritize cybersecurity and risk management strategies. With the increasing digitization of operations and the growing interconnectedness of systems, the need for robust cyber insurance coverage will only intensify in the coming years.

The Global Third Party Cyber Insurance market is witnessing a dynamic shift driven by the escalating threat landscape of cyberattacks and data breaches. With the digital transformation of businesses across industries, the emphasis on cybersecurity measures has never been more critical. This paradigm shift has propelled the demand for comprehensive cyber insurance coverage to mitigate financial risks and safeguard against reputational damage resulting from cyber incidents. Organizations are increasingly turning to third-party cyber insurance providers to ensure they have the necessary support and protection in the event of a security breach.

One of the emerging trends in the Global Third Party Cyber Insurance market is the customization of insurance products based on specific industry needs. Insurers are tailoring their offerings to cater to sectors such as healthcare, retail, government, financial services, technology, and more, understanding the unique cybersecurity challenges each sector faces. This industry-specific approach enables organizations to access policies that address their vulnerabilities and compliance requirements effectively.

Another key trend reshaping the market is the expanding adoption of cyber insurance among Small and Medium Enterprises (SMEs). While large enterprises have traditionally been early adopters of cyber insurance, SMEs are increasingly recognizing the importance of protecting their digital assets and operations. As cyber threats become more sophisticated, SMEs are acknowledging the value of insurance coverage to mitigate financial losses and ensure business continuity in the face of cyber incidents.

Market players are focusing on enhancing their service offerings by providing not only financial protection but also proactive risk assessment services and incident response support. Insurers like AIG, Chubb, Zurich Insurance Group, and others are investing in innovative solutions to address emerging cyber risks and ensure that their clients have access to comprehensive coverage. With the regulatory landscape evolving to impose stringent data protection and privacy compliance measures, the role of third-party cyber insurance in helping businesses navigate these requirements becomes even more critical.

Looking ahead, the Global Third Party Cyber Insurance market is poised for substantial growth as organizations continue to prioritize cybersecurity as a fundamental aspect of their risk management strategies. The rapid digitization of operations and the increasing interconnectivity of systems further underline the necessity of robust cyber insurance coverage. As the market evolves, we can expect to see continued innovation from market players, increased adoption of cyber insurance across industries, and a heightened focus on proactive cybersecurity measures to mitigate cyber risks effectively.The Global Third Party Cyber Insurance market is experiencing a transformative phase driven by the escalating threat landscape of cyberattacks and data breaches. As businesses globally undergo digital transformation, the importance of robust cybersecurity measures has become paramount. This shift in focus has led to a surge in demand for comprehensive cyber insurance coverage to mitigate financial risks and protect against reputational damage stemming from cyber incidents. Companies are increasingly turning to third-party cyber insurance providers to ensure they have the necessary support and protection in the event of a security breach.

An emerging trend in the market is the customization of insurance products to meet specific industry requirements. Insurers are tailoring their offerings to cater to sectors such as healthcare, retail, government, financial services, and technology, understanding the distinct cybersecurity challenges each sector faces. This industry-specific approach enables organizations to access policies that address their vulnerabilities and compliance needs effectively.

Furthermore, there is a notable increase in the adoption of cyber insurance among Small and Medium Enterprises (SMEs). While large enterprises historically led in the uptake of cyber insurance, SMEs are now recognizing the critical importance of safeguarding their digital assets and operations. With cyber threats evolving in complexity, SMEs are acknowledging the value of insurance coverage to mitigate financial losses and ensure business continuity in the event of cyber incidents.

Market players are enhancing their service offerings by not only providing financial protection but also offering proactive risk assessment services and incident response support. Insurers like AIG, Chubb, Zurich Insurance Group, and others are investing in innovative solutions to address emerging cyber risks and ensure clients have access to comprehensive coverage. As regulatory requirements around data protection and privacy become more stringent, the role of third-party cyber insurance in helping businesses navigate these mandates becomes increasingly vital.

Looking to the future, the Global Third Party Cyber Insurance market is poised for significant growth as organizations continue to prioritize cybersecurity as a fundamental component of their risk management strategies. The rapid digitization of operations and the increasing interconnectedness of systems underscore the necessity of robust cyber insurance coverage. As the market evolves, we can anticipate continued innovation from market players, expanded adoption of cyber insurance across industries, and a heightened emphasis on proactive cybersecurity measures to effectively mitigate cyber risks.

The Third Party Cyber Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-third-party-cyber-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Regional Analysis/Insights

- The Third Party Cyber Insurance Market is analyzed and market size insights and trends are provided by country, component, products, end use and application as referenced above.

- The countries covered in the Third Party Cyber Insurance Market reportare U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

- North America dominatesthe Third Party Cyber Insurance Market because of the region's high prevalence Third Party Cyber Insurance Market

- Asia-Pacific is expectedto witness significant growth. Due to the focus of various established market players to expand their presence and the rising number of surgeries in this particular region.

Browse More Reports:

Global Modulators Market

Global Paprika Market

Global Office Furniture Market

Global Mining Machinery Market

Canada Mobile Cardiac Telemetry (MCT) Market

Global Ice Detection System Market

Global Foot and Ankle Devices Market

Global Biometric Identity Solutions Market

Global Gummed Tape Market

Global Hemodialysis Equipment Market

Middle East and Africa e-Clinical Solutions Market

Global Ginseng Extracts Market

Global Boils Treatment Market

Global Electric Outboard Engines Market

Global Application Modernization Services Market

Europe Cell Based Assays Market

Global Healthcare Data Informatics Software Market

Global Kraft Paper Packaging Market

Global Mosquito Repellent Candle Market

Global Sterility Indicators Market

North America Chemical Surface Treatment Market

Global Fruit Brandy Market

Global Ampoule Cream Market

Asia-Pacific Insight Engines Market

Global Over-night Hair Treatment Products Market

Global Account Based Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]