Gold has always been a universal store of value, and today, many investors prefer gold bars for long-term security and wealth preservation. Behind every gold bar lies a trusted manufacturer, and these producers are known as gold mints. Understanding the role of gold mints helps gold mints investors make informed choices when buying bullion.

What Are Gold Mints?

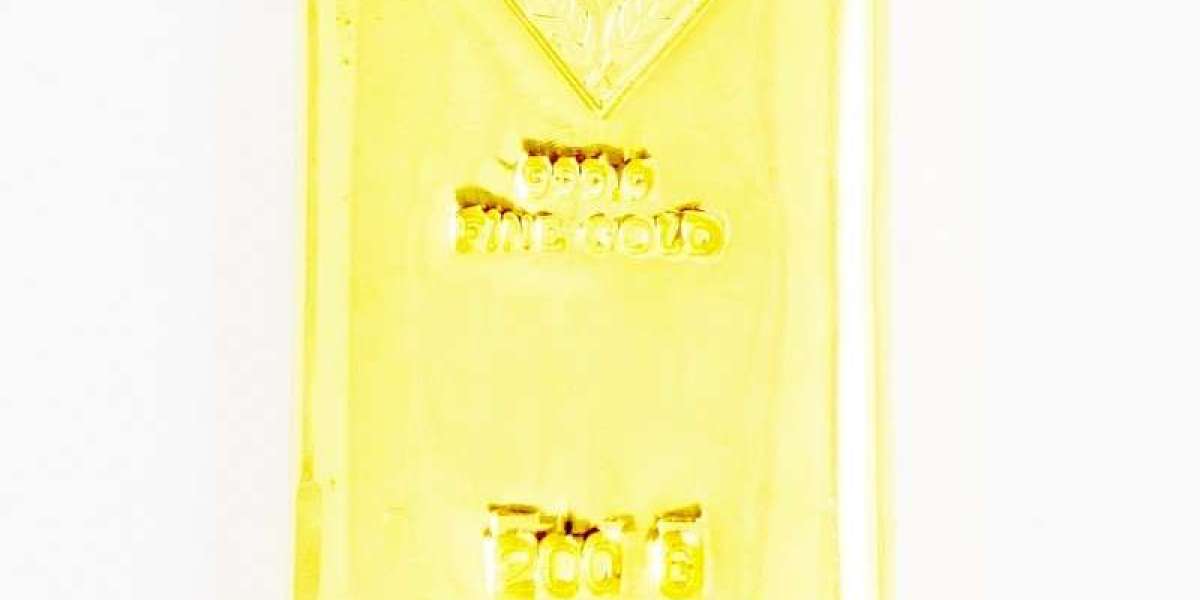

Gold mints are refineries or official institutions that produce gold bars, coins, and bullion products. They are responsible for refining raw gold to high levels of purity—often 999.9 fine gold (24 karat)—and shaping it into standard forms for investment and trade. Each mint stamps its bars with details such as weight, purity, and a unique hallmark, guaranteeing authenticity and global recognition.

Famous Gold Mints Worldwide

The Royal Mint (UK): Known for its historic coinage and modern bullion bars, including special editions like the Diwali gold bar.

PAMP Suisse (Switzerland): Famous for its Lady Fortuna design, PAMP is a leading producer of minted gold bars.

Valcambi (Switzerland): Renowned for its Combibar design and high-quality investment bars, including 100g and 1kg options.

Heraeus (Germany): A respected name producing fine gold bars in various sizes, from 1g to 1kg.

Perth Mint (Australia): Globally recognized for its Kangaroo gold bars and unique collectible bullion.

Rand Refinery (South Africa): The producer of the world-famous Krugerrand coins and fine gold bars.

Why Gold Mints Matter for Investors

Authenticity and Trust: Gold bars from reputable mints carry globally recognized hallmarks, making them easy to trade.

Purity Assurance: Most leading mints guarantee 999.9 fine gold, ensuring investment-grade quality.

Variety of Options: Gold mints produce a range of bars, from small 1g minted bars to large 1kg bullion bricks.

Global Liquidity: Bars from renowned mints can be bought and sold worldwide with ease.

Design and Collectability: Some mints, like PAMP Suisse and Perth Mint, create artistic designs, adding aesthetic and collectible value.

Gold Bars from Mints

When investors buy a gold bar from a mint, they receive more than just precious metal—they gain peace of mind. Popular sizes include:

10g and 20g gold bars for beginners.

100g and 250g bars for balanced investments.

1kg bars for serious investors seeking bulk value.

Each bar is usually delivered in sealed packaging with an assay gold mints certificate, further proving its authenticity.

Final Thoughts

Gold mints are the backbone of the bullion industry, ensuring that every gold bar meets the highest standards of purity, weight, and trust. Whether buying a small minted gold bar or a large 1kg bullion piece, choosing products from established mints guarantees global recognition, secure value, and lasting financial protection.

Would you like me to also write a dedicated article on “top 5 gold mints in the world” to highlight which ones investors should prioritize when buying bars?